Non-resident "Indian Citizens" Startup-in-India: but how??

Dear OFBJP, "The Brilliant Babus of "PM Modi's न्यू India" won't provide Latest&Correct Info in-spite of dozens of follow-ups, and Ministry of Corporate Affairs provides contradictory information!!"

. . . Man-Made-Poverty. . .

India is among the World’s Richest Country but 80 crore (800 Million) poor people i.e., more than half of India’s about 1.43 Billion people are Very Poor who need food subsidy to survive: why?

Intelligence: what's the mystery? Truth Decay: how the “truth” gets decayed?

Dear Overseas Friends of BJP,

Non-resident "Indian Citizens" Startup-in-India: but how??

"The Brilliant Babus of PM Modi's न्यू इंडिया won't provide Latest&Correct Information in-spite of dozens of follow-ups, and Ministry of Corporate Affairs (Government of India) provides contradictory information!!”

And BJP MPs & Ministers? BJP MPs & Ministers (on my mailing list) possibly think that “SILENCE Is Power” and never replied to any emails they received and read, often re-read many times!!

Since Dec 2023, I have been writing and making phone calls; recently I also sent them emails via Substack to get to know whether the “recipients of my emails” are opening the emails or not, and how many times did they open the emails:

Not sure my last email dated 1 March 2024 addressed to Honorable President of India & Honorable Prime Minister of India reached them or not; that email I sent after many follow-ups emails sent to Govt of India Officials at different levels: [roc.kolkata@mca.gov.in … klp.prasad@mca.gov.in … ceo@mygov.in … amitabh.kant@nic.in … secy.mca@nic.in …]

. . . Silence Is Power?. . .

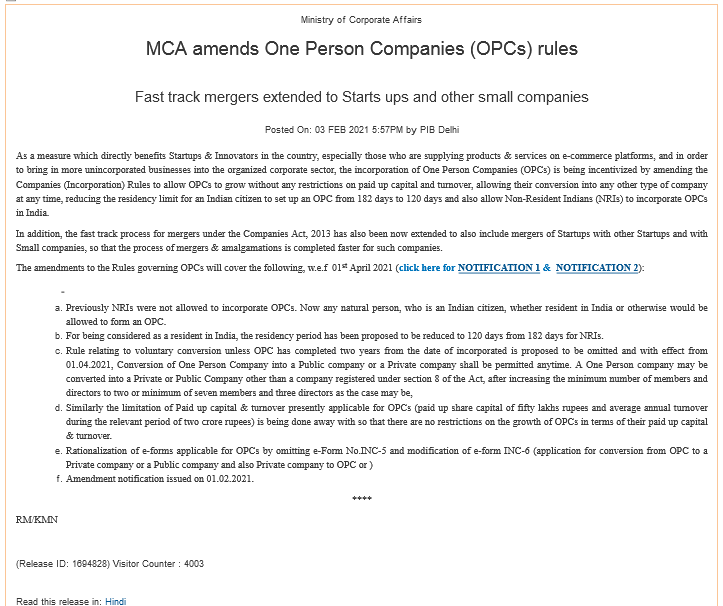

I also wonder why all of the Govt of India officials (whom I sent several emails) decided neither to provide me any information, nor to update the web-page of MCA: https://www.mca.gov.in/MinistryV2/onepersoncompany.html w.r.t. the amendment: https://pib.gov.in/PressReleasePage.aspx?PRID=1694828

“One Person Company” Registration in India.

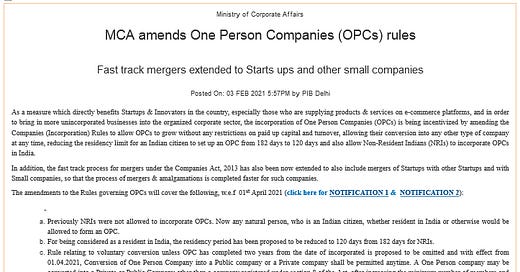

First: https://pib.gov.in/PressReleasePage.aspx?PRID=1694828

"… natural person, who is an Indian citizen, whether resident in India or otherwise would be allowed to form an One Person Company (OPC); no restriction on the growth of OPCs in terms of their paid up capital and turnover …"

Next Contradictory Information on: https://www.mca.gov.in/MinistryV2/onepersoncompany.html Conflicting information on the website of the Ministry of Corporate Affairs, Government of India:

Only a natural person who is an Indian citizen and resident in India shall be eligible to act as a member and nominee of an OPC.

For the above purpose, the term "resident in India" means a person who has stayed in India for a period of not less than one hundred and eighty two days during the immediately preceding one financial year.

In case the paid up share capital of an OPC exceeds fifty lakh rupees or its average annual turnover of immediately preceding three consecutive financial years exceeds two crore rupees, then the OPC has to mandatorily convert itself into a private or public company.

***

Other Related Points w.r.t. One Person Company in India, were:

"Name reservation: RUN service shall be used for name availability":

What is RUN?

DIGITAL INDIA → What’s the link to Government of India website to get more information?

Other Questions Were:

What are the functions and responsibilities of the member of a One Person Company in India?

What are the functions and responsibilities of the member of a One Person Company in India?

What are the documents needed to register a One Person Company in India?

Can a One Person Company in India be registered while living outside India?

Are there any standard/sample MoA, AoA, etc available on mca.gov.in website for One Person Company which any entrepreneur can use as a base document to prepare their own MoA, AoA, etc?

Non-resident "Indian Citizens" Startup-in-India: but how??

***

"The Brilliant Babus of PM Modi's न्यू इंडिया won't provide Latest&Correct Info in-spite of dozens of follow-ups, and Ministry of Corporate Affairs provides contradictory information!!”

For details you may refer below:

First Reference: https://pib.gov.in/PressReleasePage.aspx?PRID=1694828

Second Reference: https://www.mca.gov.in/MinistryV2/onepersoncompany.html

1 How to incorporate an OPC?

Incorporation through SPICe (Without filling RUN)

Stakeholders can avail of 5 different services (Name Reservation, Allotment of Director Identification number (DIN), Incorporation of New Company, Allotment of PAN and Allotment of TAN) in one form by applying for Incorporation of a new company through SPICe form (INC-32) - Simplified Proforma for Incorporating Company electronically (SPICe) - with eMoA (INC-33), eAOA (INC-34).

In case eMoA, eAoA are not applicable, users are required to attach the pdf attachments of MoA and AoA. There is no need for reserving a name separately before filing SPICe.

One name for the proposed company can be applied through SPICe (INC-32).

Incorporation through SPICe (With RUN)

Name reservation: RUN service shall be used for name availability.

Incorporate OPC: After name approval, form SPICe shall be filed for incorporation of the OPC within 20 days from the date of approval of RUN.

The company shall file form INC-22 within 30 days once form SPICe is registered in case the address of correspondence and registered office address are not same.

2. How to inform RoC about change in membership of OPC?

The company shall file form INC-4 in case of cessation of membership of OPC on account of death, incapacity to contract or change in ownership. In the same form, the user needs to provide details of the new member of the OPC.

.

3. Is there any threshold limits for an OPC to mandatorily get converted into either private or public company?

In case the paid up share capital of an OPC exceeds fifty lakh rupees or its average annual turnover of immediately preceding three consecutive financial years exceeds two crore rupees, then the OPC has to mandatorily convert itself into a private or public company.

.

4. How to intimate RoC that the OPC has exceeded the threshold limits and require conversion into private or public company?

The OPC shall inform RoC in form INC-5, if the threshold limit is exceeded and is required to be converted into a private or public company.

5 What is the time limit for filing form INC-5?

Form INC-5 shall be filed within sixty days of exceeding threshold limits.

.

6. Is there any form that is to be filed for conversion of an OPC into a private or public company? Is there any other purpose for filing this form?

Form INC-6 shall be filed by an OPC for conversion of an OPC into a private or public company.

Yes, the private company will also file form INC-6 for converting itself into an OPC. The paid up share capital of the private company should not be exceeding fifty lakh rupees and should not have average annual turnover more than two crore rupees at the time of such conversion into OPC. The company shall have one member and shall appoint one nominee to act as member in case of death or incapacity of the member at the time of conversion into OPC.

.

7. What is the time limit for filing form INC-6?

Form INC-6 shall be filed within 30 days in case of voluntary conversion and within six months of mandatory conversion.

.

8. Who is eligible to act as a member of an OPC?

Only a natural person who is an Indian citizen and resident in India shall be eligible to act as a member and nominee of an OPC.

For the above purpose, the term "resident in India" means a person who has stayed in India for a period of not less than one hundred and eighty two days during the immediately preceding one financial year.

.

9. A person can be a member in how many OPCs?

A person can be a member in only one OPC.

.

10. What if a member of an OPC becomes a member in another OPC by virtue of being a nominee in that other OPC?

Where a natural person, being member in One Person Company becomes a member in another OPC by virtue of his being a nominee in that OPC, then such person shall meet the eligibility criteria of being a member in only one OPC within a period of one hundred and eighty days, i.e., he/she shall withdraw his membership from either of the OPCs within one hundred and eighty days.

.

11. Which form is to be filed in case of withdrawal of consent by the nominee of an OPC or in case of intimation of change in nominee by the member?

Form INC-4 shall be filed in case of withdrawal of consent by the nominee or in case of intimation of change in nominee by the member.

Welcome. Welcome Back to India!!

Non-resident "Indian Citizens" Startup-in-India: but how?? https://madhabpaul.substack.com/p/non-resident-indian-citizen-startup-in-india-how

Start-up India & JOB Creation in India: There are many such topics to talk about for the Peace-Prosperity of our mother land India.

Professional Profile: https://innovation.mitaservices.com/dr-madhab-paul-professional-profile-cec01ada366aProfessional Services as: Director, Country Director, Managing Director, Business Development Director, Director for Innovation, Consultant, Professor of Practice, Advisor, and Keynote Speaker; available for hybrid, digital-global work, and onsite work; … May I help you? Can Read More!!

ISBC - the International Strategic Business Concepts, The 5 Points:

Global Startups,

Branding Worldwide,

Doing & Expanding International Business easily, effectively and profitably,

Power for Progress, and

Tricks, Wisdom & Strategy for Landslide Victories!!

MiTA stands for “Management, Innovation & Technology Applications” in International Strategic Business.

I have ongoing book writing project — books on global startups, branding worldwide, international business, digital governance, and strategy based on practical experience and academic research.

“বল বল বল সবে, শত বীণা-বেণু-রবে / ভারত আবার জগত সভায়, শ্রেষ্ঠ আসন লবে …”“Bolo bolo bolo sobe, Shoto bina benu robe / Bharat abar jogot sobhay, Sreshtho ason lobe. …” — is a patriotic song written by Shri Atulprasad Sen, an Indian lyricist, composer and by profession a lawyer (20 October 1871 – 26 August 1934).

. . .

“Having been reminded of his powers by Jambavan, the king of the bears, (श्री राम भक्त हनुमान) Hanuman crossed the strait between India and Lanka in one leap, despite the efforts of watery demonesses to stop him by swallowing him or his shadow. He was discovered in Lanka, and his tail was set on fire, but he used that fire to burn down Lanka.” --- The Story of Shri Ram Bhakta Hanuman (Ramayana) in short from Britannica!!

Why eagle does not fight snake on the ground?

Best Wishes,

Dr. Madhab Paul, PhD

ISBC - the International Strategic Business Concepts!!

https://madhabpaul.com , https://mitaservices.com

MiTA stands for “Management, Innovation & Technology Applications” in International Strategic Business.